2024 NC Commissioner of Insurance Candidates

Special | 26m 46sVideo has Closed Captions

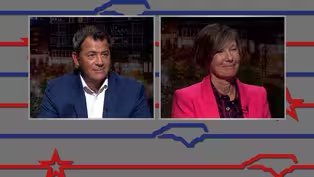

Mike Causey (R) and Natasha Marcus (D) discuss their campaigns for NC Commissioner of Insurance.

Candidates Mike Causey (Republican) and Natasha Marcus (Democrat) discuss their campaigns for NC Commissioner of Insurance. Hosted by PBS NC’s Kelly McCullen, these interviews were recorded on July 22 and August 15, 2024.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

State Lines is a local public television program presented by PBS NC

2024 NC Commissioner of Insurance Candidates

Special | 26m 46sVideo has Closed Captions

Candidates Mike Causey (Republican) and Natasha Marcus (Democrat) discuss their campaigns for NC Commissioner of Insurance. Hosted by PBS NC’s Kelly McCullen, these interviews were recorded on July 22 and August 15, 2024.

Problems playing video? | Closed Captioning Feedback

How to Watch State Lines

State Lines is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipMore from This Collection

During major election cycles, PBS North Carolina's public affairs team sits down for in-depth conversations with candidates running for Governor and Council of State positions. PBS North Carolina has invited major party candidates to a one-on-one interview with State Lines host and executive producer Kelly McCullen. Interviews are scheduled throughout the summer.

2024 NC Commissioner of Agriculture Candidates

Video has Closed Captions

Sarah Taber (D) and Steve Troxler (R) discuss their campaigns for NC Commissioner of Agriculture. (26m 46s)

2024 NC Commissioner of Labor Candidates

Video has Closed Captions

Luke Farley (R) and Braxton Winston II (D) discuss their campaigns for NC Commissioner of Labor. (26m 46s)

2024 NC Secretary of State Candidates

Video has Closed Captions

Elaine Marshall (D) and Chad Brown (R) discuss their campaigns for NC Secretary of State. (26m 46s)

Jessica Holmes, Democratic Candidate for NC Auditor

Video has Closed Captions

An interview with Jessica Holmes, Democratic candidate for NC Auditor (2024). (12m 32s)

Dave Boliek, Republican Candidate for NC Auditor

Video has Closed Captions

An interview with Dave Boliek, Republican candidate for NC Auditor (2024). (12m 58s)

2024 NC Lieutenant Governor Candidates

Video has Closed Captions

Hal Weatherman (R) and Rachel Hunt (D) discuss their campaigns for NC Lieutenant Governor. (26m 46s)

Michele Morrow, Republican Candidate for NC Superintendent of Public Instruction

Video has Closed Captions

An interview with Michele Morrow, GOP candidate for NC Superintendent of Public Instruction (2024). (12m 57s)

Maurice "Mo" Green, Democratic Candidate for NC Superintendent of Public Instruction

Video has Closed Captions

An interview with Mo Green, Democratic candidate for NC Superintendent of Public Instruction (2024). (13m 7s)

Video has Closed Captions

Wesley Harris (D) and Brad Briner (R) discuss their campaigns for NC Treasurer. (26m 46s)

Video has Closed Captions

Josh Stein (D) discusses his campaign for NC Governor. (26m 46s)

Jeff Jackson, Democratic Candidate for NC Attorney General

Video has Closed Captions

An interview with Jeff Jackson, Democratic candidate for NC Attorney General (2024). (12m 50s)

Dan Bishop, Republican Candidate for NC Attorney General

Video has Closed Captions

An interview with Dan Bishop, Republican candidate for NC Attorney General (2024). (12m 44s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship- Meet the Republican and Democratic nominees for North Carolina Commissioner of Insurance on this special Election 2024 edition of State Lines.

[dramatic music] Hello, I'm Kelly McCullen.

This special State Lines will introduce us to the candidates for North Carolina Commissioner of Insurance.

Just a bit of a background on the Department of Insurance.

It was created in 1899.

Its commissioner serve four year terms and do not face term limits.

The State Department of Insurance regulates insurance companies.

They'll get involved in rate adjustment requests, handle customer service issues, and it will also investigate cases of alleged insurance fraud.

Mike Causey wants a third term as commissioner of insurance.

He took office in 2017, you're the only Republican to ever win insurance commissioner, and you join us now.

It's good to see you again, sir.

- Thank you, Kelly, it's good to be here.

Thanks for having me.

- We've done this three times now with you as commissioner or as candidate and both.

Every time we meet the state's larger an influx of new state voters are here.

They have to look down this ballot, your name's on there.

Who are you, what's your background and tell us more about yourself.

Well, I'm a lifelong farmer, I'm a Guilford County native from rural North Carolina, really just outside of Greensboro, but I grew up on a dirt road produce farm.

And, as a kid, I helped in the fields growing produce and learned how to drive a tractor at probably five years old and just loved that lifestyle.

It's where I still live today.

I went through the public schools, went through to Wake Tech, studied engineering, civil engineering technology, have an associate's degree from there, and served in the United States Army Military Police School and I also played in the Army band, and came back home, and worked as a field engineer in the construction industry.

Went back to college at UNC Charlotte, studied engineering, got recruited into the insurance business.

And my career was mostly in the insurance field as an agent, agency manager, superintendent of agencies.

So I know the insurance business well from all levels.

And then, went back to college, got a degree in business administration and went through MBA studies and taken numerous courses in insurance and leadership management, Purdue University, Insurance Management Institute.

And have been active in Republican politics all my life.

But I grew up in a staunch Democratic family.

So I know North Carolina and I know the North Carolina political landscape.

And I have enjoyed my eight years serving the people as insurance commissioner - In a state that's increasingly seeing its cities get larger and some of the more rural areas become less populated, you're still proud of your background, but how do you mesh growing up rurally, as a farmer, owning a farmer's market with going to college, training, going into the business world and then, basing your career now out of Raleigh?

- Well, I started in the insurance business in Charlotte.

So for 12 years I was active in the Charlotte community.

I was active in civic clubs, in the Hornet's Nest Kiwanis Club, active in the Charlotte Life Underwriters Association.

So got to know the city of Charlotte well, but still connected to my rural background, and rural roots, and having worked in Raleigh for decades, I've enjoyed both sides.

- Let's get down to business now, - [Mike] Sure.

- Commissioner.

- How's the insurance market, especially for property and car insurance?

How's it changed since COVID?

- It's changed in that you still have more Zoom and virtual meetings than we once had prior to COVID.

And it changed the business model of many businesses where they saw that they could save money by not having as many in-person meetings.

Although, I prefer the in-person meetings when possible.

But we are lucky in North Carolina to have a safe and healthy insurance market compared to many other states.

And we do have, what they call, a hard insurance market.

Many insurance companies do not want to write homeowners insurance, it has not been profitable for many insurance companies.

But when it comes to automobile insurance, Forbes Advisory Services did a study for 2023 and says North Carolina actually is number five, the fifth lowest in the United States when it comes to car insurance.

And that speaks very highly for North Carolina.

The only states with lower average automobile insurance rates are Idaho, Maine, Vermont, and New Hampshire and Ohio.

- Why is that?

What about those four states, or five states makes North Carolina behind them but ahead of so many others?

- Well, if you look at those, most of those are low population states other than Ohio.

And I think it's because we have hundreds of insurance companies willing to write automobile insurance, and people have a lot of choices.

We have a number of insurance companies based right here in North Carolina.

And so, we have a system that's different.

It gets criticized, the North Carolina Rate Bureau was created by the legislature back in 1977.

So we're a rate bureau state and regardless of who the insurance commissioner is, the insurance commissioner has to operate under state statute according to what the legislature set forth.

- Is the property insurance market in North Carolina weak?

You've said it is unprofitable.

Why would any company want to offer dwelling policies under such a scenario?

- Well, I think they do better in North Carolina than they do some other states, but there's a number of factors.

You look at the storms, the hailstorms, hurricanes, tornadoes that we've experienced.

It's created a large number of claims, but inflation is a huge factor that it affects all sides of business, but you also have fraud.

There's a tremendous amount of insurance fraud that is driving up our insurance premiums.

And we see that, especially after a storm when we have hurricanes or tornadoes, we have these...

Some con artists, they come in from outta state, they go door to door, they offer to give you a free roof.

And so, we are very aggressive at the Department of Insurance in fighting insurance fraud and doing everything we can to hold down insurance rates.

And, at the same time, having a level playing field and even handed enforcement so insurance companies will want to do business here.

- How close is North Carolina to experiencing what policy holders are experiencing in California and Florida where companies just pull out and refuse to do business, which would leave people in a lurch?

- Well, I don't think we're anywhere close to that.

I mean, you look at the problems they're having in Florida and California and some of those other states, it is a serious, serious issue.

And there's tremendous pressure already to raise insurance rates and, as commissioner, my job is to protect consumers.

- In protecting consumers, this is one question I have 'cause all of us pay insurance, what's an acceptable amount of rate increase?

Some candidates in the past have said no increases under any circumstances.

Some worry that increases are gonna be too much.

How do you balance that out?

Because we want the insurance company to be there if we need them, but we also want low rates that might be unsustainable.

- That's right, and it is a balancing act.

But, of course, nobody wants any increase, but you don't want to an increase in your groceries, you don't want an increase at the fuel pump.

But we've seen, especially over the last few years, we've seen tremendous damage because of inflation.

People cannot stand fuel prices at $4 and up.

We had diesel fuel in Guilford County the other day at $5 a gallon.

And that hurts farmers, it hurts truckers, it hurts all businesses.

And I do not buy into this push to force everybody to drive electric vehicles.

- [Kelly] Right.

- People should have choices, but we need to be energy independent, we need low energy prices, that's the best cure for inflation.

- As insurance commissioner, is it part of any commissioner's job to advocate for any kind of policies with the legislature?

Are you there to just interpret what the legislature would like for the commissioner to do?

And I say that because you have the Rate Bureau, it's sort of an anomaly in America and how rates are set.

More free market, does the Rate Bureau do the job as intended in 1977 - Well.

- [Kelly] As well today?

- There's all different views and the insurance industry is divided, you have some insurance companies that don't want to change a thing, they like the Rate Bureau system.

And there's other companies that would like to do away with the Rate Bureau and just have a totally free market system.

And then, other companies that would like a combination of free market and Rate Bureau.

And what we have done in my eight years, we have worked with the Rate Bureau and the legislature to give insurance companies more freedom, and more flexibility and more free market choices to go around the Rate Bureau in some cases.

And that has helped to some extent.

But you can't argue with the success of North Carolina over the decades that we have been a pretty strong, stable insurance market and the Rate Bureau system has worked well.

I don't see any appetite in the legislature to do away with the Rate Bureau or make drastic changes.

I think the system we have now is working well and there's certainly some tweaks that need to be made and we'll work on those.

- What is the proper relationship between a department of insurance and any insurance company that does business here?

Are you their partner, or are you their colleague, or are you their watchdog and adversary?

- We're regulators, so we are certainly not opposed to the insurance companies, but my job is to protect consumers, but I have to follow state law.

And state law says the first job of the insurance commissioner is to make sure the rates are adequate.

Now, when you talk about rate adequacy, that means insurance companies have to charge enough rate so they have the money to pay claims.

It's not going to do you any good as consumer if you're paying premiums, and insurance company cannot pay claims.

The other thing the insurance commissioner's directed to make sure the rates requested are not excessive, or not unfairly discriminatory to any area of the state.

And that's what I've been doing.

- In the practical sense, how much voice does the ordinary person have out there when they write you, Rate Bureau comes up, we know the companies are asking for an increase.

Do people have a voice?

- Yes.

How, much does it influence the negotiation?

- Oh, they have a strong voice.

Every time there's a rate request hike, I get thousands and thousands of letters, emails from consumers and it makes a huge difference.

These comments are for public record, they go to legislators, the Rate Bureau sees those also.

It's very important for people to let their voice be heard.

- Commissioner Causey, you are the Republican nominee for Commissioner of Insurance in North Carolina.

As always, good to have you in the studio.

Thank you for being on State Lines in the past and hope you'll come back, safe travels.

Good luck on the campaign trails, a lot of mileage there.

- Thank you Kelly, appreciate you having me.

- All right, well, absentee ballots will start being mailed out in early September.

Early in person voting begins October 17th, 2024, will end on November 2nd, 2024.

Traditional election day is November 5th with absentee ballots also being due on that deadline, November 5th.

And if you vote, you will be asked to present a photo ID.

[dramatic music] Joining me is Senator Natasha Marcus, a Democrat running for North Carolina's Commissioner of Insurance.

Senator, thanks for being here today.

- Thank you for the opportunity and I appreciate PBS providing this public service so voters know more about these council state races.

- It's our pleasure, thank you for booking an interview for State Lines.

First of all, one thing about council of state races in North Carolina, you run as hard as you can, you spend money, you buy ads, and so many voters don't know who their candidates are.

Who's Natasha Marcus, what led you to run for Commissioner of Insurance?

- You're right, so many people tell me they don't even know that we vote on Commissioner of Insurance.

So I again appreciate this opportunity.

I'm Natasha Marcus, proud to have been serving in the North Carolina Senate now for three terms, representing my district in Mecklenburg County.

I grew up in a small college town in a rural part of New York.

My dad was an elected official and a lawyer.

He liked to call himself a country lawyer.

And my mom was a 35 year public school teacher.

The kind of teacher who to this day have students reach out to her to tell them how important she was to to their education.

So I'm always proud of where I came from.

So I didn't grow up in North Carolina, but I'd like to say I got here as quick as I could.

Came down for law school in 1991 and never left.

I practiced law in Greensboro with a firm there, did litigation work and then moved to Davidson where I live now.

Raised my two daughters here, they're both grown and adults.

One's a teacher herself now and one is studying, she's a PhD scientist studying addiction and married to a naval officer.

So I have served in the Senate, as I said, six years.

I'm on various committees, the one most relevant for today's discussion is the Commerce and Insurance Committee.

- I had that written down as a question too.

One thing I did not hear you say in your biographical sketch there was, have you ever worked in the insurance industry?

Some candidates do, some legislators do.

What's your link with insurance as a career?

Or is that something you noticed when assessing the race?

- My career has always been about advocacy.

So when I was a litigation attorney, I advocate for my clients.

As a parent, I advocate for my kids.

And as a senator, I advocate for my constituents.

And I think that's what the voters of North Carolina need and should have in their commissioner of insurance, not someone who's entangled with the insurance companies.

My opponent, the incumbent commissioner of insurance, used to be an industry lobbyist and has a lot of connections with and, in my opinion, is too cozy with the insurance companies because this role is to represent the people of North Carolina and advocate for them, and their best interest, and their wallets not the insurance companies so... - Yeah, as a department, as an entire department, not just as a commissioner, what should the relationship be between the state agency called Department of Insurance and all the insurance companies out there that, quite frankly, we all count on?

- Right so I'm glad you asked that because, again, a lot of voters don't understand.

The Rate Bureau is a non-governmental entity that represents the insurance companies.

They're a professional organization.

Their job is to make sure that insurance companies can make as much profit as possible, that's their goal.

The commissioner of insurance is the one person who we, as North Carolinians, have an opportunity to elect once every four years.

And the role of commissioner of insurance is to represent the people and to keep rates as low as possible while still having a vibrant marketplace of insurance options.

As you said, we don't wanna drive insurance companies out of our state, we don't wanna become Florida, right?

We want them to want to write policies here.

And in order to do that, they're entitled to earn a reasonable profit.

Reasonable though, Kelly, not whatever they want.

It's a regulated market because people are required to have these forms of insurance, homeowners, auto insurance, workers' comp, and it's supposed to be a fair price.

That right balance between enough profit for the insurance companies that they want to do business here, but an affordable price for North Carolinians.

And so you asked, what's the relationship supposed to be?

It's supposed to be a little bit adversarial.

The commissioner of insurance is supposed to say, when the Rate Bureau comes and asks for yet another rate hike, he's supposed to say, "Well, wait a minute, prove to me, "show me the data that explains and justifies "why you think you need to raise "your rates again on North Carolinians."

And if the Rate Bureau can't provide that data to prove that it needs to go up, then the commissioner of insurance is supposed to say, "No rates are not going up" And unfortunately under the incumbent commissioner of insurance, that relationship has not been very adversarial.

He time and time again, 16 times in a row, has agreed to raise rates and never once required that public hearing on a rate hike to force the insurance companies to justify it, show us the data.

It's supposed to be a public hearing under oath testimony, subject to cross examination about what have you actually paid out in claims in North Carolina, what are you paying your top executives, what are your profits off of North Carolinians, here?

And only then, if it's justified, should rates ever go up.

- So you would do public hearings?

- Absolutely, the previous commissioners of insurance did the public hearings so the public could see is there data to justify a rate hike or not?

And without a public hearing, there hasn't been one, even one in eight years under the incumbent commissioner of insurance, we have no basis on which to understand why rates would go up at all.

And if they need to go up.

And sometimes they do, you know, as I said, they are entitled to make a reasonable profit, but what is the right number, what is a fair number?

We don't know because there's never been a public hearing under Mike Causey.

And that's a major lack of transparency.

That is, in my mind, the biggest part of the job of insurance commissioner, to make sure that rates don't go up one penny more than they are supposed to.

So the public hearings are... that's what's lacking under Mike Causey and something I am determined to bring back.

- What challenges do you think insurance companies are legitimately facing in this state in terms of things about our society, inside our state borders that do affect revenue and do affect payouts?

- Yes, so first let me say, we know from the data that was provided by AM Best and analyzed by the New York Times recently that insurance companies here in North Carolina on homeowners policies, the one policy that they claim that they lose money on, they have made profits 9 out of the 10 past years here in North Carolina, pretty big profits.

And they are using those profits that they're making here in our state to offset losses in other states.

Interestingly, states like Iowa, so not even a coastal state, but states like Iowa, they're losing money and they're earning more here to offset those losses there.

That's exactly what our North Carolina Commissioner of Insurance is supposed to be protecting us from so I will say that upfront.

There is a tough market, it's a hard market right now, global reinsurance is really tough to find, particularly for companies that do business in states that aren't dealing well with the ever increasing storms.

We have a big coastline here in North Carolina.

We have a lot of low lying land in our state.

So we are more vulnerable to the changes in the climate that we've seen, and the ever strengthening storms and the damage that they do.

So we have to be mindful of that.

The better we are about facing that head on and encouraging mitigation efforts and resiliency efforts, the better our market will be for insurance here in North... We want to not only have insurance companies wanting to write policies here, but for them to be able to buy the reinsurance that they need to stay solvent.

- You know, your service with three terms, state senate commerce and insurance committee, you brought that up.

What did that teach you about the insurance market as you were absorbing all this policy coming in?

More importantly, if you're elected, you have to deal with your senate colleagues, the GOP majority, likely.

How's all that gonna work for you over four years?

- I think it's a huge benefit I have that my opponent doesn't have that I have served in the legislature, I understand how the legislators work and have served on the committee, as you mentioned, commerce and insurance.

I am in the minority party in the Senate and one of the loud voices in opposition to some of the policies that I think hurt North Carolina and hurt our insurance market.

So the most prominent of which is a bill that the governor just vetoed last month, I'm hoping his veto will hold because it was a bill pushed by the Home Builders Association here in North Carolina that has a huge lobbying power in our state government to stop us from updating our building codes that directly impacts insurance because we have not updated our building codes in more than 20 years.

So new homes are being built that are not up to modern energy efficiency standards and not up to the building codes that are gonna make homes resilient against these ever strengthening storms.

So when legislators allow their friends, their lobbyists to influence them in a way that makes bad policy, not updating building codes, that has huge impacts on North Carolinian's wallets, but also our ability to be eligible for FEMA reimbursement funds after big storms.

We're already not eligible to apply for and receive some FEMA recovery money because our building codes are not up to date.

And then, of course, homeowners build a brand new home and are paying more than they should for energy and their homes are not fortified against big storms.

- It's just money.

- So that's a problem.

- It's just money, senator.

Let me ask you about that, you could go in a million directions as insurance commissioner, like you say, going into resiliency and where do you focus when you come into office?

Do you stick right to those rates or is there much more to it than that?

- So there's a whole lot that the insurance commissioner does and I'm eager to tackle a lot of it.

I would say the top three issues for me are: the transparency, we gotta bring back transparency.

Public hearings are a big part of that.

Advocacy, we have got to get back to working on behalf of the people.

Again, the job is not to work for insurance companies.

They have the Rate Bureau, they have their people to advocate for them.

It's the people of North Carolina who are lacking an advocate right now.

The Consumer Relations Division, Consumer Protection Division at the Department of Insurance has been whittled down, fewer and fewer staff there.

So when a typical North Carolinian who is having trouble getting his or her claim paid on a policy, they've been paying their premiums year after year and now, they need coverage if they're having trouble getting what is due them, they're supposed to be able to call the Department of Insurance and have someone there who's ready to fight for them, and make sure they understand their policy, and are getting what they're entitled to.

And I look forward to reinvigorating that effort because that is a part of the job that I think, again, directly impacts North Carolinians.

And so, it's so important that we bring those things back and focus again, on what the job is.

North Carolina is 1 of only 11 states, I don't know if you knew that, that allows the people of the state to elect their commissioner of insurance.

Most states it's an appointed position.

The people have no say whatsoever and no way to hold that person accountable.

But in North Carolina, we vote this person in or out and this is our chance to get someone in there who's gonna work for the people of North Carolina.

- There you go, Natasha Marcus, Democratic nominee for Commissioner of Insurance in North Carolina.

Thank you so much.

- Thank you for the opportunity.

- Thank you for watching, folks, if you want more information, visit our website, pbsnc.org/vote.

I'm Kelly McCullen, we'll see you soon.

[dramatic music] - [Announcer] Quality Public Television is made possible through the financial contributions of viewers like you, who invite you to join them in supporting PBS NC.

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

State Lines is a local public television program presented by PBS NC